After a year of investing and trading cryptocurrencies, in a few weeks from now, it’s time to file our tax returns. Filing taxes include crypto gains, losses and income. If you’ve only been buying and selling crypto assets in one exchange, you can write your own code that will calculate profit / loss. I posted a tutorial Creating a Python Web App to Display Binance Portfolio Profit Loss. But when you did more than trading, e.g. earned rewards, deposit to or withdraw from another cryptocurrency, airdrops, etc. writing your own code will get more complicated.

Here’s a web application I found that calculates cryptocurrency trading gains for free and in real-time. It’s called Koinly. What’s even better about Koinly is that if you upgrade your subscription, you can download a complete tax report, including forms such as IRS Form 8949 and Schedule D. No need to do the calculations by yourself!

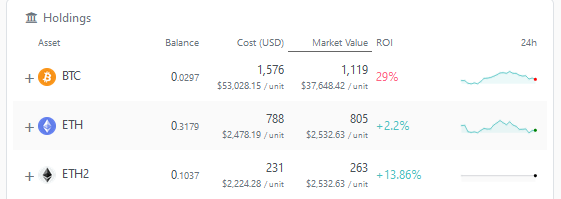

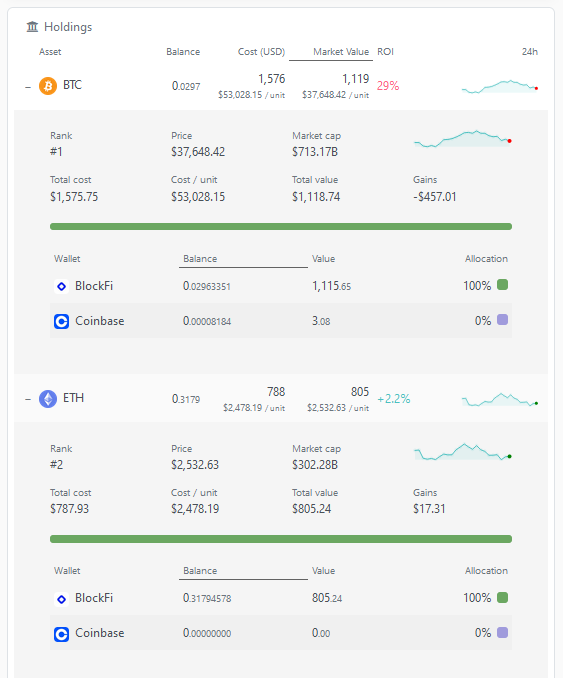

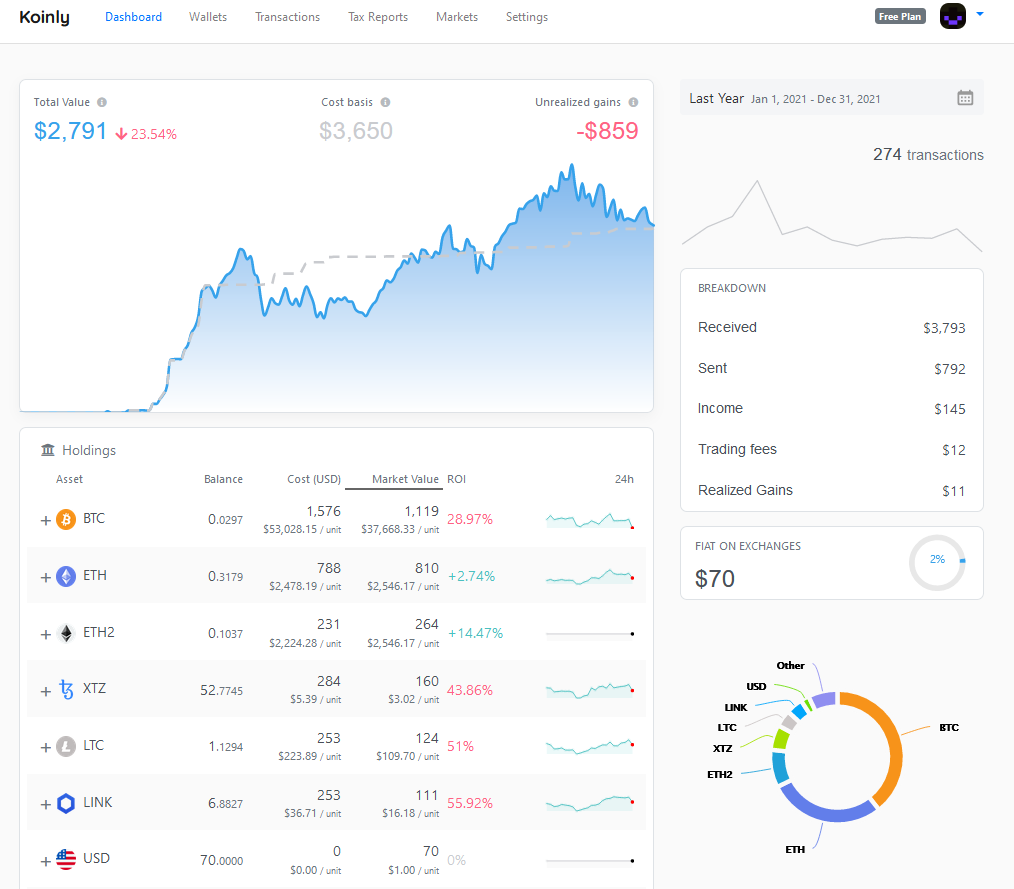

A sample screenshot of Holdings with the summary of balance, cost basis, market price, gains % (ROI) and snapshot chart.

When you expand the asset’s row, the details such as rank, market cap, total gains, wallets’ allocation will be displayed.

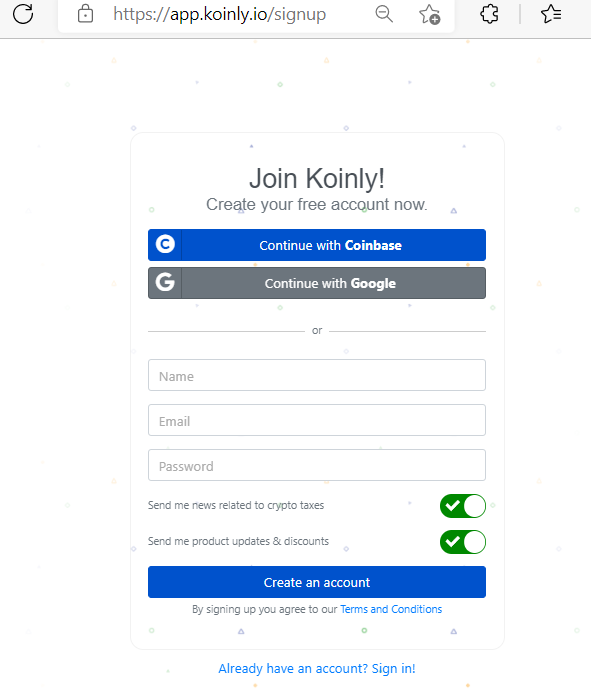

To create an account and start exploring Koinly, here are the steps:

Step 1. Enter your name, email address and password. Click the Create an account button. A welcome email will be sent to your email address.

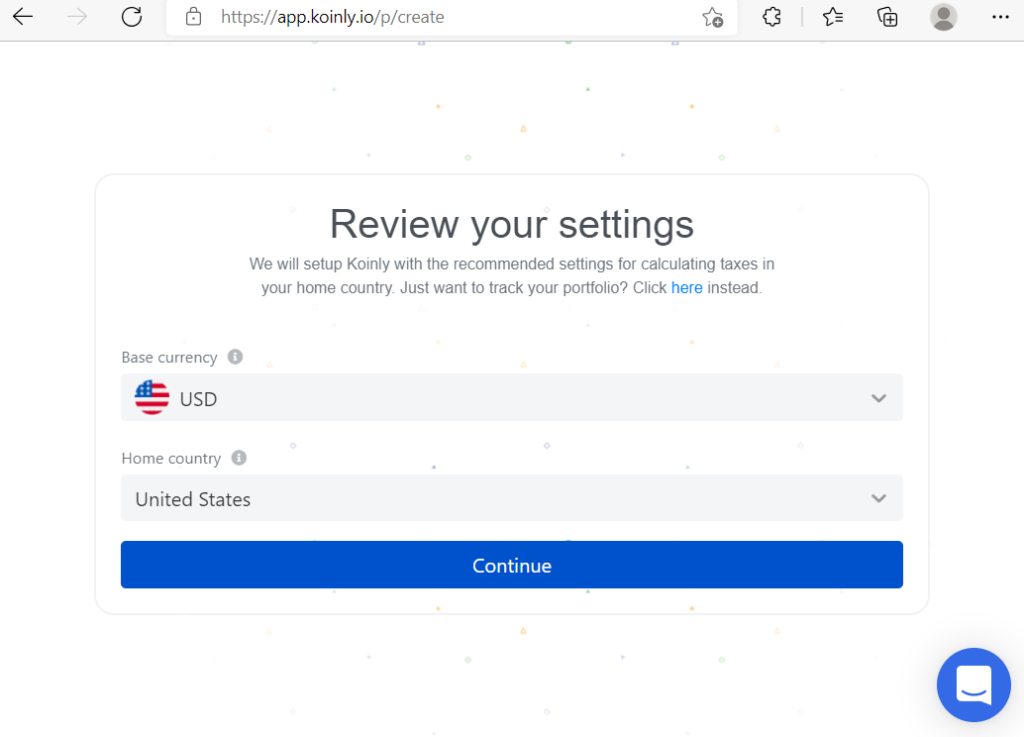

Step 2. Select your Base currency and Home country

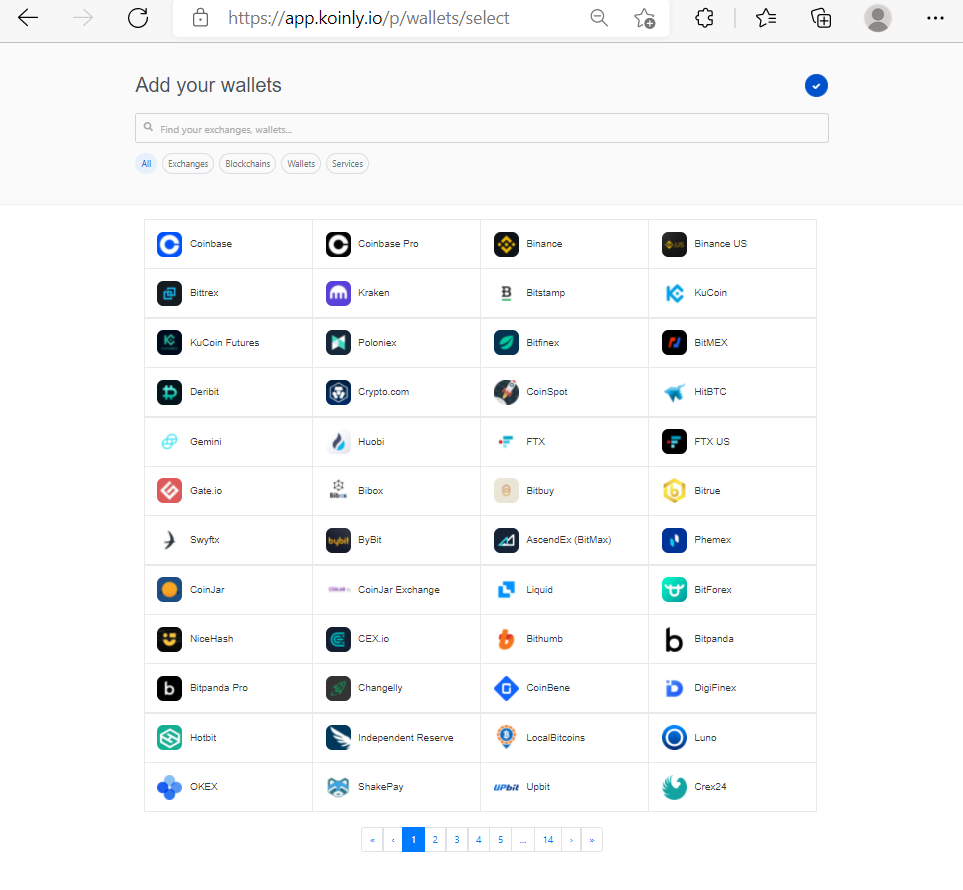

Step 3. You have an option to add the source of your transactions. It can be from cryptocurrency exchanges, blockchains, crypto wallets and services. In Koinly, these are collectively called Wallets. If you do not have the details ready, click on the blue check mark to the right of “Add your wallets“. You can add wallets at a later time by clicking the Wallets tab -> Add wallet / exchange

If you have your wallet details ready, select from the list or filter by categories.

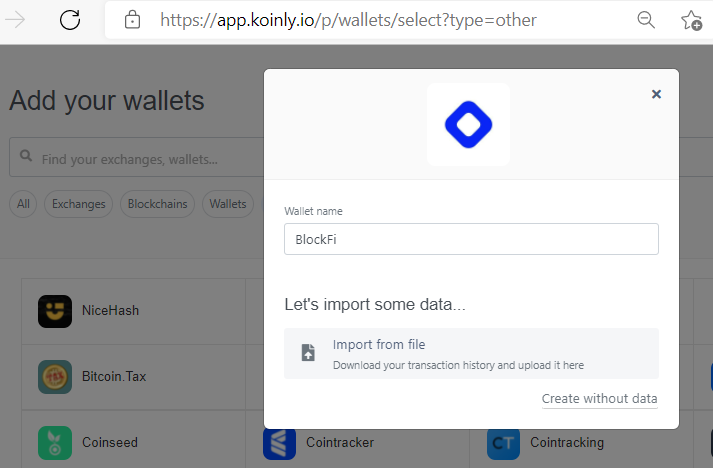

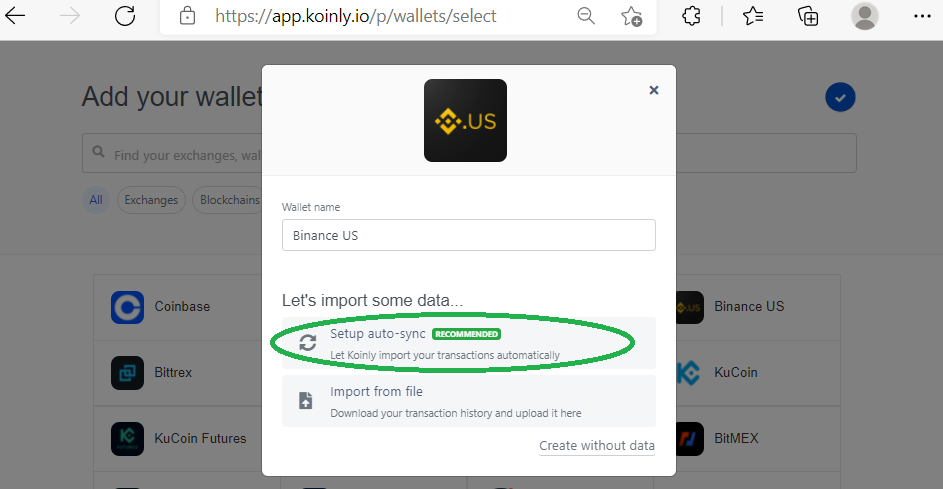

Step 4. If you selected a wallet on the previous step, there are several ways to import transactions data.

4a) One way is to download transactions file from your exchange (in CSV format) and upload the file manually to Koinly.

4b) Another way is to import the transactions automatically via API or authorized login. I recommend this if your transaction includes deposit to or withdraw from another crypto wallet, rewards, airdrops, etc.

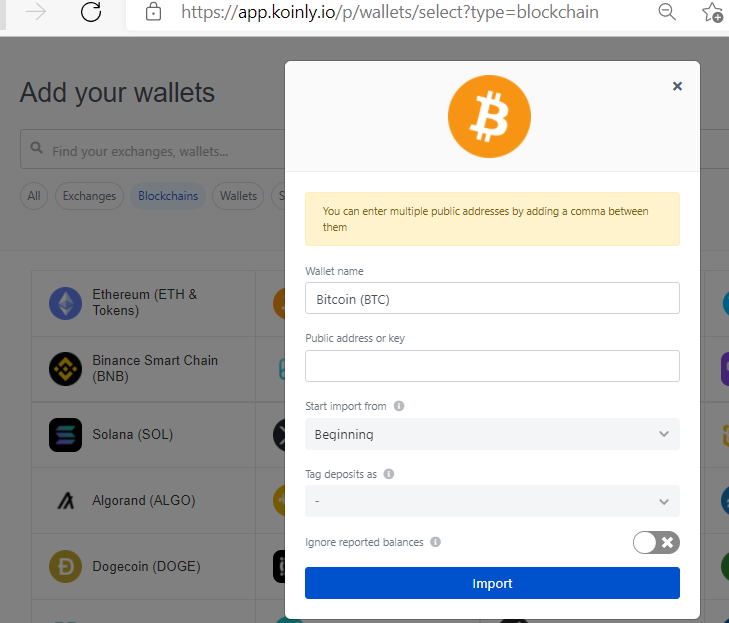

4c) Still another way is by entering the public addresses of your blockchains

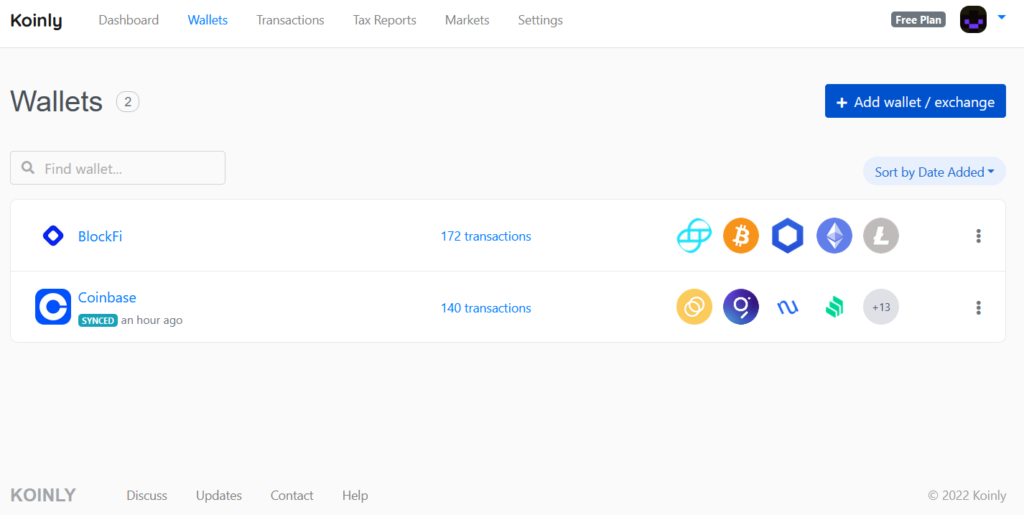

Step 5. After adding the transactions, the Wallets tab will display the total number of transactions and the cryptocurrencies for each wallet.

On the Dashboard tab, Koinly provides a chart of all assets imported from your wallets.

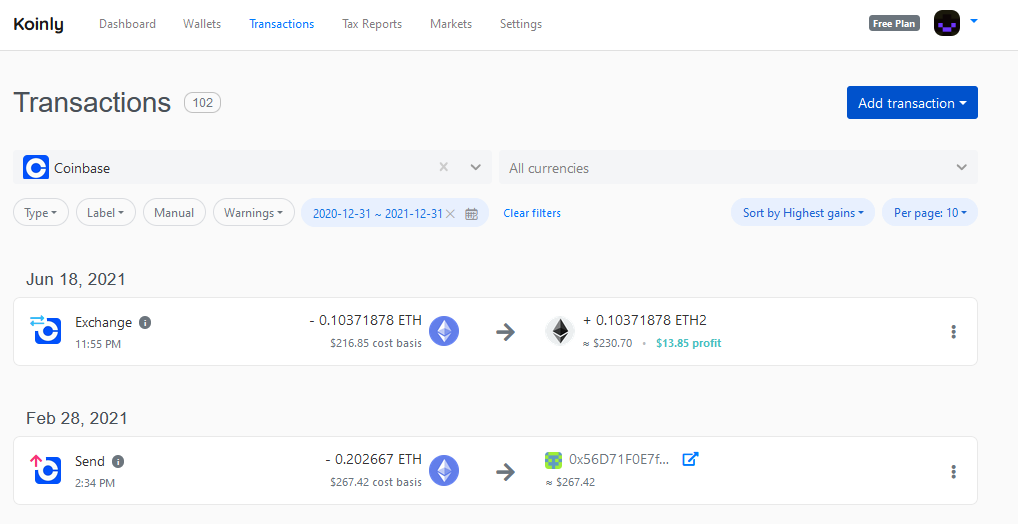

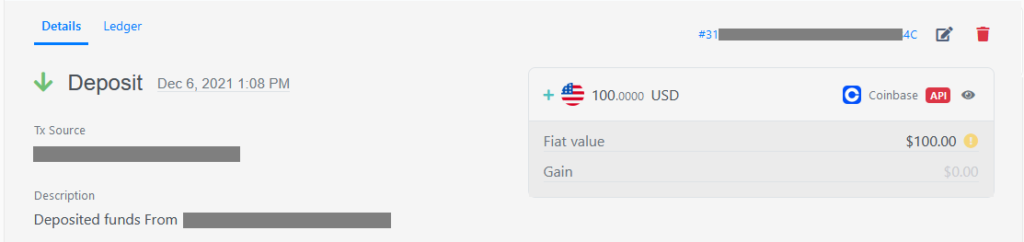

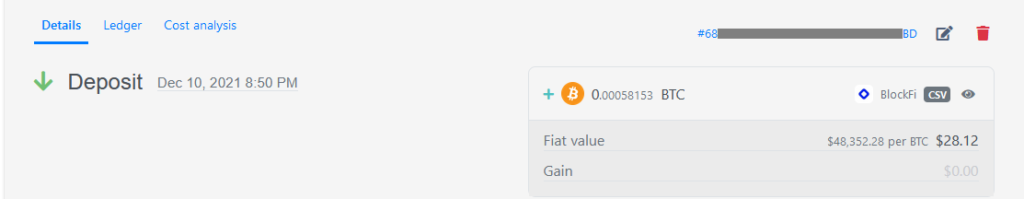

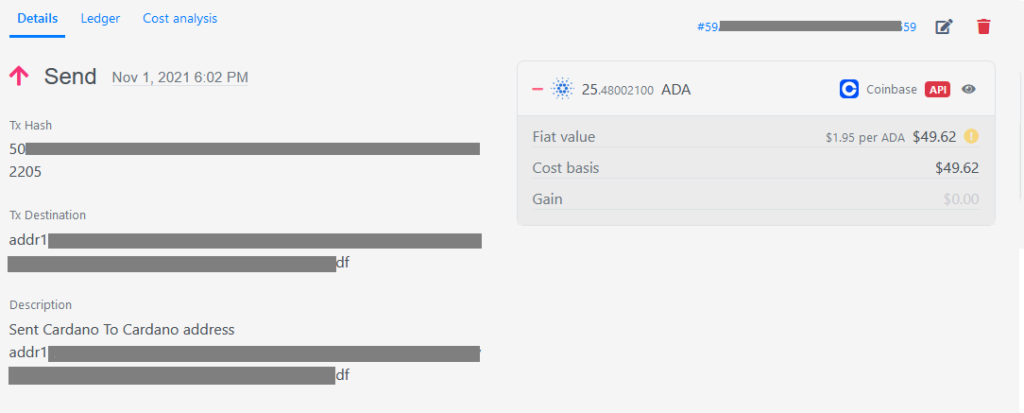

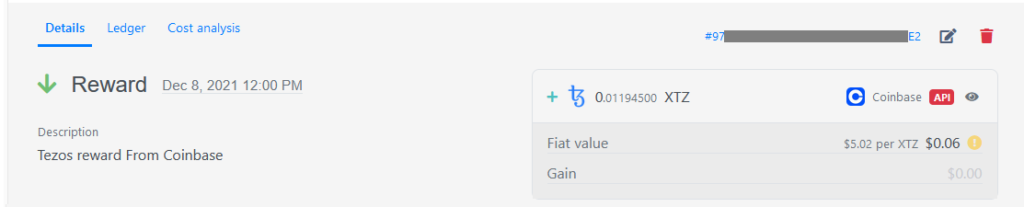

Transactions tab lists down deposits, withdrawal, transfer, send, income, reward, mining, airdrop, etc. When you click on a transaction, the details will be displayed.

Sample Deposit from bank transaction:

Sample Deposit from crypto transaction:

Sample Send transaction:

Sample Reward transaction:

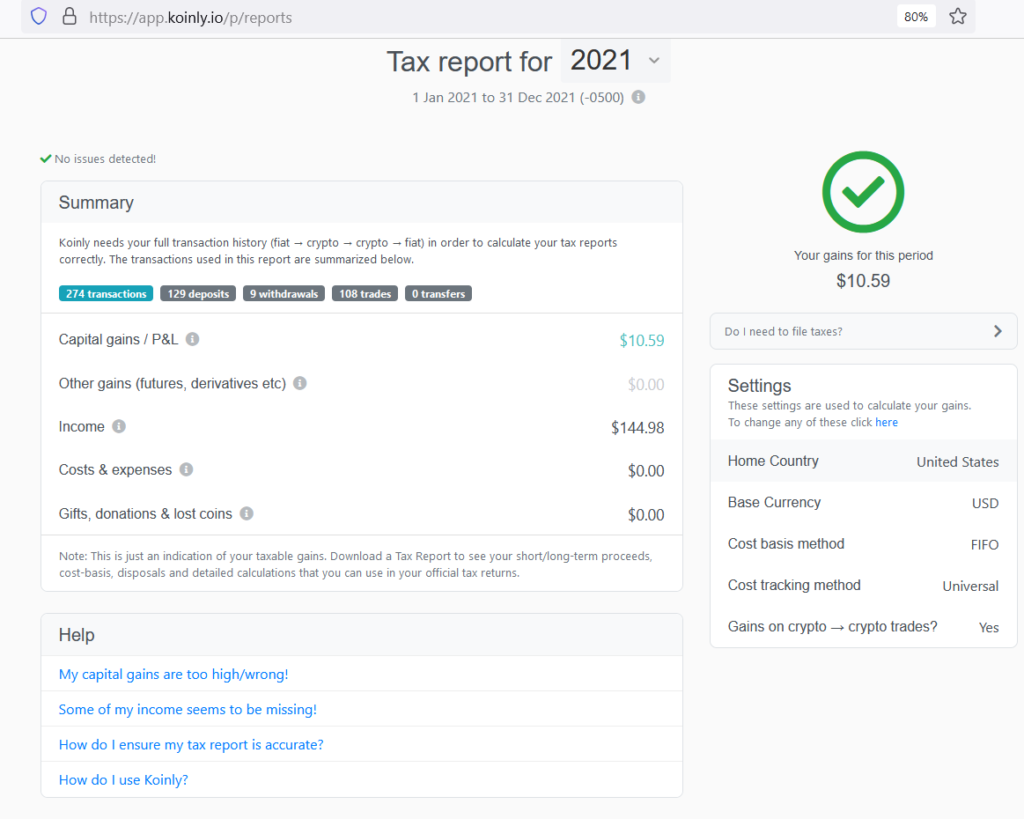

Tax Reports tab shows summary of all transactions for the year.

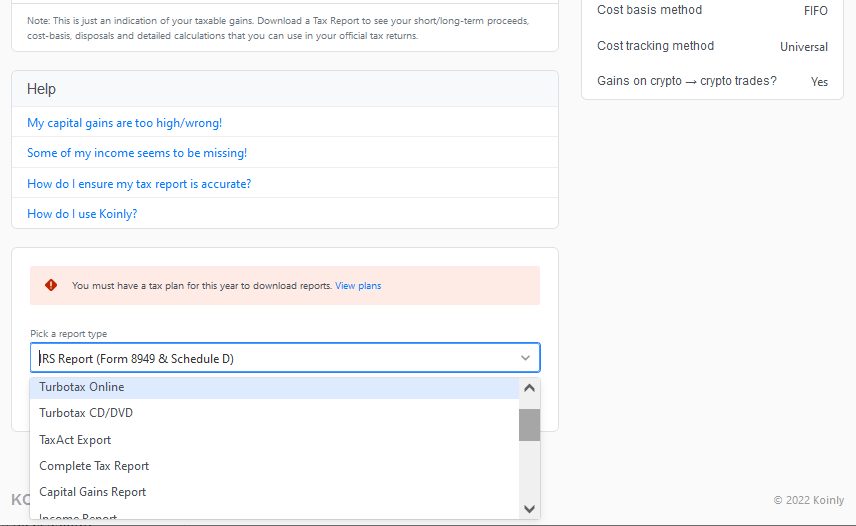

Koinly generates a wide variety of report. However you must upgrade your subscription to be able to download the reports.

List of reports:

- IRS Report (Form 8949 & Schedule D)

- Turbotax Online

- Turbotax CD/DVD

- TaxAct Export

- Complete Tax Report

- Capital Gains Report

- Income Report

- Other Gains Report

- Gifts, Donations & Lost Asset

- Expenses Report

- End of Year Holdings Report

- Highest Balance Report

- Buy/Sell Report

- Transaction History

Hopefully my blog post gave you a hope that calculating your gains should not be frustrating at all.

Sign up for Koinly account and take advantage of the 30% discount. The sale ends on February 1st, 2022. Here is the link to Koinly with my referral code.

Thanks!